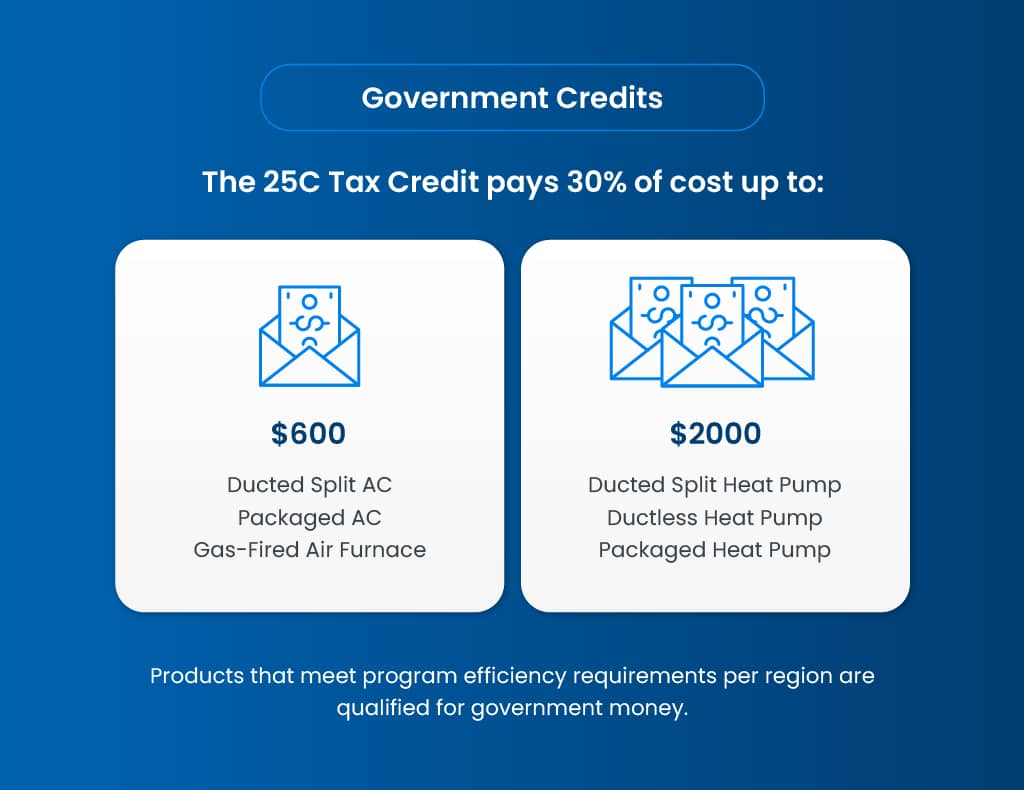

- Government money covers 30% of costs

- up to $2,000 for eligible heat pumps!

- up to $600 for eligible ACs & furnaces!

- Receive funds as a tax credit

- All households are eligible

Details

- Available now by 25C Tax Credit law as part of Inflation Reduction Act

- Effective Jan 1, 2023 to Dec 31, 2032

- Must be homeowner’s principal residence

- Cannot combine with the “High-Efficiency Electric Home Rebate Program”

How to view products that qualify for government money

1 Visit any of these product categories:

Standard Central Air Conditioning Condensers * SEE FOOTNOTE

Heat Pump Central Air Conditioning (Electric Heat and Cool) * SEE FOOTNOTE

Natural Gas / Propane (LP) Fuel, Furnaces

Single Zone Mini-Split Systems

Central Heating & Cooling Complete Systems

Ultra Efficient Ducted Heat Pump Air Handler Complete Systems

* FOOTNOTE: AC and heat pump condensers must be paired with appropriate indoor equipment for the system to meet the minimum efficiency necessary to qualify for the tax credit. See FAQ section below for more information.

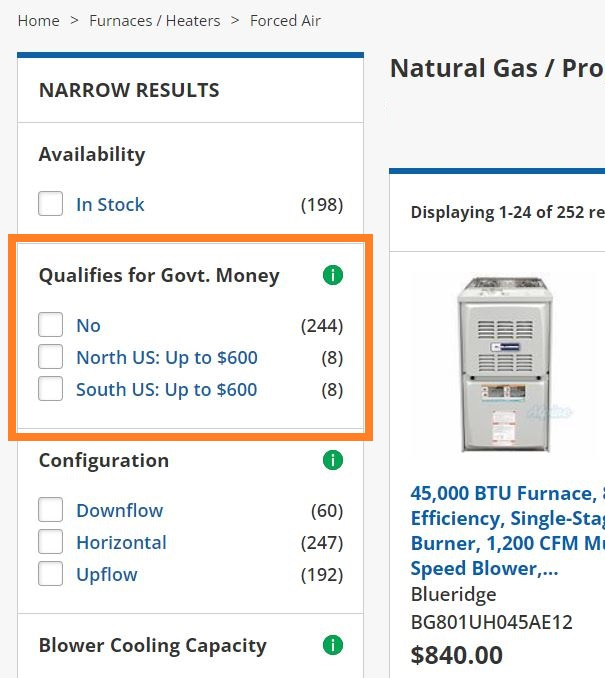

2 Look for the filter “Qualifies for Govt. Money” and select your region:

After you check the box for your region, you’ll see displayed a filtered list of products that qualify for a tax credit of 30% of product cost up to amount shown. This amount is also displayed on product pages under the “Specs” section. This is the maximum tax credit amount available for that product for your region.

How to easily calculate your tax credit amount

EXAMPLE 1

Your Home Location: South US

Product Cost: $1,000

Alpine Product Shows: South US Up to $600

Math: $1,000 x .30 = $300

Math Explained: $300 is 30% of product cost and below the $600 tax credit limit

Your Tax Credit: $300

EXAMPLE 2

Your Home Location: North US

Product Cost: $3,000

Alpine Product Shows: North US Up to $2,000

Math: $3,000 x .30 = $900

Math Explained: $900 is 30% of product cost and below the $2,000 tax credit limit

Your Tax Credit: $900

EXAMPLE 3

Product Cost: $7,000

Alpine Product Shows: North US Up to $2,000

Math: $7,000 x .30 = $2,100

Math Explained: 30% of the product cost is $2,100, but since the maximum tax credit limit is $2,000, your tax credit is capped at the top limit.

Your Tax Credit: $2,000

Frequently asked questions

How do I claim my tax credit?

To claim your tax credit, you will need to fill out IRS Form 5695 by following the IRS instructions. Include this completed form when filing your federal tax return. Include any relevant product receipts.

Please note there is a difference in the program eligible tax credit amounts between Tax Year 2022 and Tax Year 2023. In 2022, tax credits cap at $300 for heat pump, air conditioners, and heating equipment. Starting in 2023 through 2032, that amount increased to $600 for air conditioners and heating equipment as 30% of the cost. Heat pump tax credits increased to a max of $2,000 per year as 30% of the cost. Click here to learn more about the differences between the programs. Please be sure you are using the proper tax form for the correct tax year.

Seek advice from a tax professional if you have questions about your specific tax situation.

Who is eligible for tax credits?

Homeowners, including renters for certain expenditures, who purchase energy and other efficient appliances and products.

What does principal residence mean?

This means your main/primary home located in the United States where you live most of the time. A temporary absence due to special circumstances, such as illness, education, business, military service, or vacation, won’t change your main home. Additional homes and part-time residences where you stay less frequently do not qualify for the tax credit. The address of your main home is required on the the IRS tax form for the credit.

Can I claim the cost of installation and related components as part of my tax credit?

Yes! The 25C Tax Credit applies to the total project cost of the installation of qualifying products. Project cost means the product cost, plus the cost of any required additional system components, and professional installation cost incurred by you. If you are purchasing any of these additional items, you can claim 30% of their cost as part of your tax credit, up to the maximum limit amount available for the main qualifying product type (heat pump, AC or furnace).

What efficiency rating is required for a product to qualify?

Electric or natural gas heat pumps; central air conditioners; natural gas or oil furnaces qualify that meet or exceed the highest efficiency tiers (not including any advanced tier) established by the Consortium for Energy Efficiency (CEE).

For products installed starting in 2023, the following provides a summary of the heating and cooling equipment minimum efficiency ratings to qualify for the 25C Tax Credit:

30% of cost up to $600 per project and up to $1,200 per year:

- All U.S. Regions:

- Air Conditioners – Split System: ≥ 16.0 SEER2 and ≥ 12.0 EER2

- Air Conditioners – Packaged Unit: ≥ 15.2 SEER2 and ≥ 11.5 EER2

- Furnaces – Natural Gas Forced Hot Air: ≥ 97% AFUE*

*Not listed in CEE specifications. Shown on page 22 in the CEE initiatives found at this webpage.

30% of cost up to $2,000 per year:

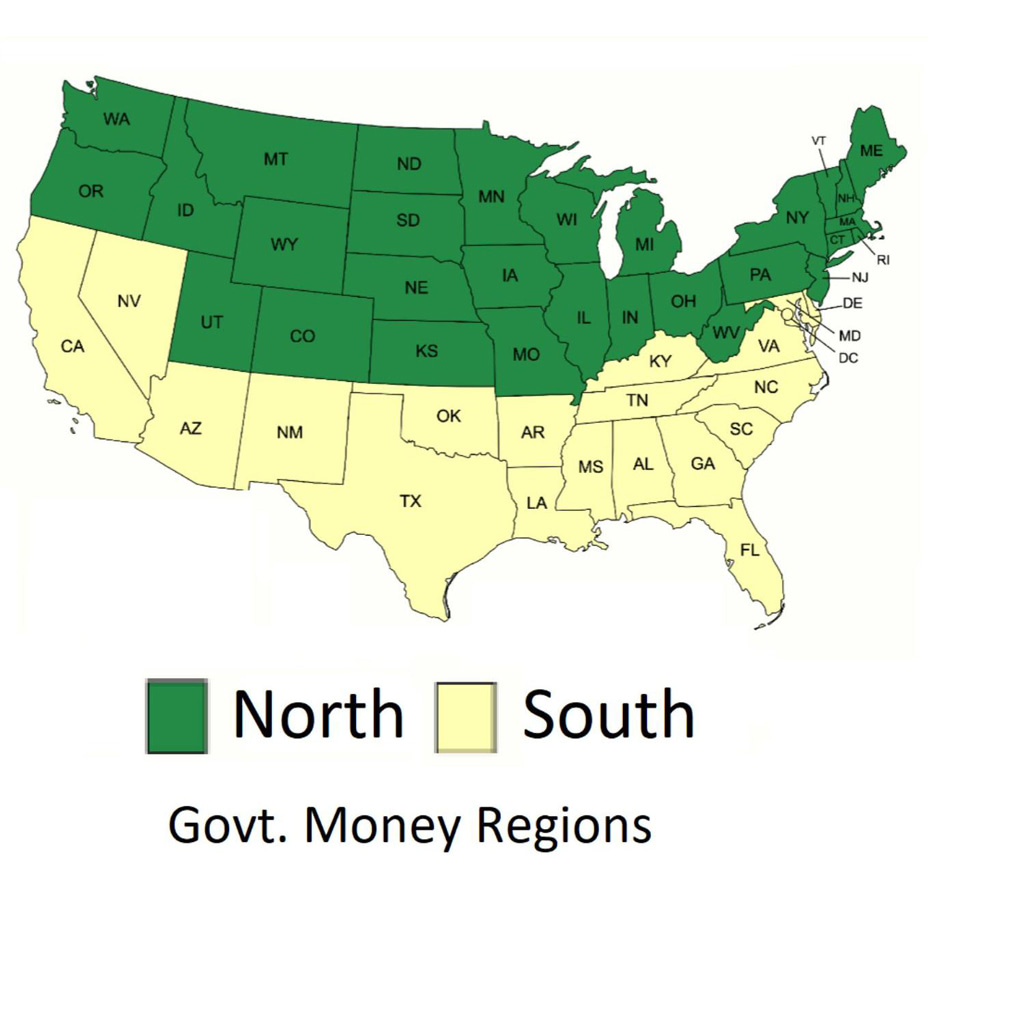

- Northern States (AK, CO, CT, IA, ID, IL, IN, KS, MA, ME, MI, MN, MO, MT, ND, NE, NH, NJ, NY, OH, OR, PA, RI, SD, UT, VT, WA, WI, WV, WY):

- Heat Pumps – Ducted Split System: ≥ 15.2 SEER2, ≥ 10.0 EER2, and ≥ 8.1 HSPF2

- Heat Pumps – Ductless Mini-Split: ≥ 16.0 SEER2, ≥ 9.0 EER2, and ≥ 9.5 HSPF2

- Heat Pumps – Packaged Unit: ≥ 15.2 SEER2, ≥ 10.0 EER2, and ≥ 8.1 HSPF2

- Additional Requirements for Northern States systems above:

- Coefficient of Performance (COP) at 5°F ≥ 1.75

- Capacity Ratio ≥ 58% when dividing the heat output at 17°F / 47°F

- Southern States (AL, AR, AZ, CA, DC, DE, FL, GA, HI, KY, LA, MD, MS, NC, NM, NV, OK, SC, TN, TX, VA):

- Heat Pumps – Ducted Split System: ≥ 15.2 SEER2, ≥ 11.7 EER2, and ≥ 7.8 HSPF2

- Heat Pumps – Ductless Mini-Split: ≥ 16.0 SEER2, ≥ 12.0 EER2, and ≥ 9.0 HSPF2

- Heat Pumps – Packaged Unit: ≥ 15.2 SEER2, ≥ 10.6 EER2, and ≥ 7.2 HSPF2

The information above is collected for your convenience and is subject to change. Seek advice from a certified tax professional.

If buying a split-system AC or heat pump condenser, what matching indoor equipment is required to qualify?

In order to qualify for the government tax credit, the HVAC system must meet the efficiency standard for your region. In the case of a split-system, “system” means the outdoor condenser or heat pump AND the indoor air handler or furnace with evaporator coil when paired together. If you’re looking at products in the two categories shown below, you’ll also need to purchase appropriate indoor equipment to qualify for the tax credit:

Standard Central Air Conditioning Condensers

Heat Pump Central Air Conditioning (Electric Heat and Cool)For help selecting the right indoor equipment, please call us and one of our product specialists will be glad to make a recommendation that’s right for you.

Does a product have to be labeled “Energy Star” to qualify?

Essentially, yes. While the program details contained in the law itself (26 U.S.C. § 25C) do not specifically mention “Energy Star” for air heating and cooling products (with the exception of oil furnaces in service within a specific date range), it does point to meeting or exceeding the highest efficiency tier (not including any advanced tier) established by the Consortium for Energy Efficiency (CEE). The lowest tiers CEE reports are the minimum requirement to be Energy Star eligible. Thus, the efficiency requirement for 25C essentially means that the products must have the same efficiency ratings as Energy Star, whether it has the label or not.

Are there limits to what consumers can claim?

Consumers can claim the same or varying credits year after year with new products purchased, but some credits have an annual limit.

Where do I get even more detailed information?

Internal Revenue Service:

https://www.irs.gov/newsroom/irs-releases-frequently-asked-questions-about-energy-efficient-home-improvements-and-residential-clean-energy-property-credits

Inflation Reduction Act of 2022 Energy Efficiency Incentives for HVAC Systems:

https://www.alpinehomeair.com/learning-center/ac-cooling/inflation-reduction-act-for-heating-and-air-conditioning-complete-article